We understand that RIAs are facing these same challenges yet with even more complexity. At Bramshill, we focus on five distinct asset classes / sectors in fixed income (investment grade and high-yield bonds, preferreds, municipal bonds, and U.S. Treasuries). RIAs, however, have even more strategies that they may utilize, many of which are advertising yield while ignoring the underlying risks. For several of our RIA and family office clients, Bramshill portfolio managers serve as an accessible resource for market insights on RIA’s underlying fixed income allocations. In that role, we urge clients to re-evaluate the quality of the yield they are implementing in client portfolios; in other words, consider the risk reward of each fixed income investment.

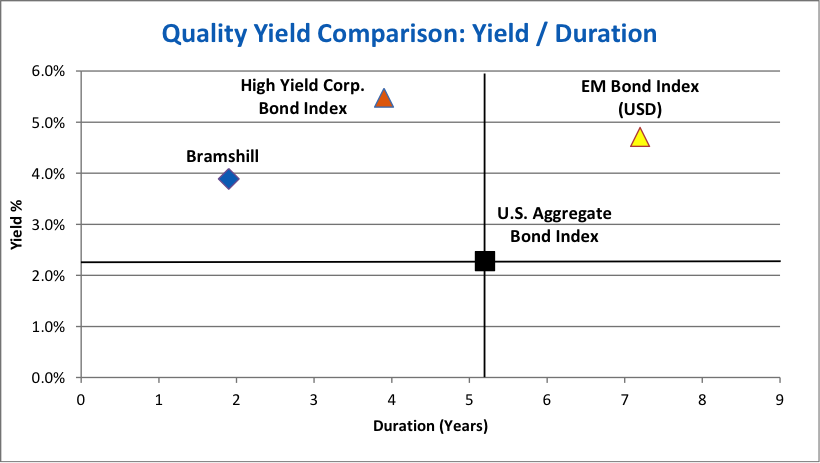

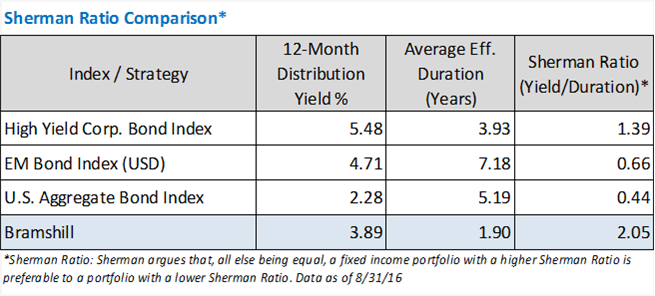

In our previous blog, we teed up five metrics for income investors to consider. Today, we will discuss the first metric, Yield relative to Duration.

Yield ÷ Duration

Jeffrey Sherman at DoubleLine Capital, a firm for which we have much respect, has defined yield/duration as “The Sherman Ratio.” A link to his paper can be found here. While it appears on the surface to be a simple metric, it is immensely valuable in a rising rate environment. The Sherman Ratio measures the amount of interest income generated relative to the interest rate risk being taken. Essentially, yield / duration measures the breakeven point at which falling bond prices will overwhelm the interest income thereby resulting in a capital loss (i.e. the percentage increase in rates that will wipe out the yield). Ultimately, when evaluating potential fixed income solutions, all else being equal, the higher the Sherman Ratio, the more your yield can withstand a rise in rates. Said another way, in a rising rate environment, falling bond prices can quickly erase one’s interest income. Risk management in core fixed income is, in our opinion, becoming a critical component of an RIA’s due diligence.